In the enigmatic realm of finance, where innovation and technology intertwine, cryptocurrencies have emerged as a force that cannot be ignored. This digital revolution has captured the imagination of investors, entrepreneurs, and tech enthusiasts alike, prompting us to delve deeper into the intricacies of this fascinating landscape.

Unraveling the Mysteries of Cryptocurrencies

Cryptocurrencies, at their core, represent a paradigm shift in the way we perceive and interact with money. Built upon the groundbreaking technology of blockchain, these digital assets offer a decentralized and secure alternative to traditional fiat currencies. The allure of cryptocurrencies lies in their ability to transcend geographical boundaries, provide enhanced privacy, and grant individuals greater control over their financial destinies.

Cryptocurrencies are not just a passing trend; they represent a fundamental shift in the way we think about money and value in the digital age.

– Vitalik Buterin, co-founder of Ethereum

The Foundations of Blockchain Technology

To truly comprehend the potential of cryptocurrencies, one must first grasp the intricacies of blockchain technology. At its essence, a blockchain is a decentralized, immutable ledger that records transactions across a network of computers. This distributed nature ensures transparency, security, and resistance to tampering, as no single entity holds control over the network.

The ingenious application of cryptographic principles and consensus mechanisms within blockchain systems enables the creation of trustless environments, where participants can engage in secure transactions without the need for intermediaries. This revolutionary approach has the potential to disrupt traditional financial systems and pave the way for a more inclusive and efficient global economy.

The Rise of Decentralized Finance (DeFi)

One of the most exciting developments in the cryptocurrency landscape is the emergence of decentralized finance (DeFi). Built upon the Ethereum blockchain, DeFi has unlocked a world of possibilities by enabling the creation of decentralized applications (dApps) that offer financial services without the need for traditional intermediaries.

- Lending and Borrowing Platforms: DeFi has given rise to decentralized lending and borrowing platforms, where users can earn interest on their cryptocurrency holdings or access loans without the need for credit checks or collateral.

- Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly from their wallets, eliminating the need for centralized exchanges and reducing the risk of hacks or security breaches.

DeFi is not just a buzzword; it’s a movement that has the potential to revolutionize the financial industry and create a more inclusive and accessible financial system for all.

– Andre Cronje, founder of Yearn.Finance

Navigating the Crypto Investment Landscape

For those seeking to capitalize on the potential of cryptocurrencies, navigating the investment landscape can be a daunting task. With thousands of digital assets vying for attention, it is crucial to approach crypto investing with a strategic mindset.

Fundamental analysis plays a vital role in identifying cryptocurrencies with strong value propositions and real-world utility. By delving into factors such as team expertise, market adoption, and technological innovation, investors can make informed decisions and mitigate the risks associated with this nascent asset class.

Investing in cryptocurrencies requires a combination of due diligence, risk management, and a long-term perspective. It’s not about chasing short-term gains, but rather identifying projects that have the potential to reshape industries and create lasting value.

– Cathie Wood, CEO of ARK Invest

The Future of Money: Embracing the Crypto Revolution

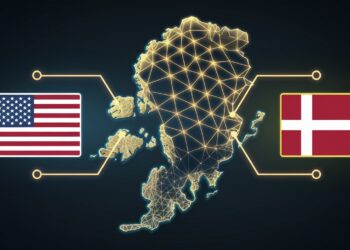

As we stand on the cusp of a new era in finance, it is evident that cryptocurrencies are poised to play a significant role in shaping the future of money. The increasing mainstream adoption of digital assets, coupled with the rapid advancement of blockchain technology, suggests that we are witnessing the dawn of a financial revolution.

Governments and central banks around the world are grappling with the implications of cryptocurrencies, with some embracing the technology and others seeking to regulate it. As the regulatory landscape evolves, it is crucial for individuals and institutions alike to stay informed and adapt to the changing tides.

Cryptocurrencies have the potential to democratize finance, empower individuals, and create a more equitable and transparent financial system. It’s not a question of if, but when this technology will become an integral part of our daily lives.

– Brian Armstrong, CEO of Coinbase

Conclusion: Embracing the Enigma

The enigmatic landscape of cryptocurrencies presents both challenges and opportunities for those willing to embrace the unknown. As we navigate this uncharted territory, it is essential to approach the crypto revolution with an open mind, a thirst for knowledge, and a healthy dose of caution.

By staying informed, diversifying investments, and embracing the transformative potential of blockchain technology, individuals and institutions can position themselves at the forefront of this digital renaissance. The future of money is upon us, and those who dare to explore the enigmatic world of cryptocurrencies will be the pioneers of a new financial frontier.