Decentralized Autonomous Organizations (DAOs) have emerged as a revolutionary governance model in the blockchain world. However, recent attacks on DAOs like Compound have exposed vulnerabilities in their “one token, one vote” structure. To ensure long-term sustainability and prevent governance attacks, DAOs could take a page from Meta’s playbook and adopt a multi-class stock system.

The Perils of “One Token, One Vote”

DAOs operate on the principle of decentralization, with token holders having equal voting rights proportional to their holdings. While this democratic approach has its merits, it also leaves DAOs open to manipulation by large token holders or coordinated groups.

The recent attack on Compound serves as a cautionary tale. A group led by an individual known as “Humpy” exploited their collective voting power to allocate $24 million worth of COMP tokens to a profit-making protocol they controlled. This incident highlights the need for more robust governance structures in DAOs.

Meta’s Multi-Class Stock Structure

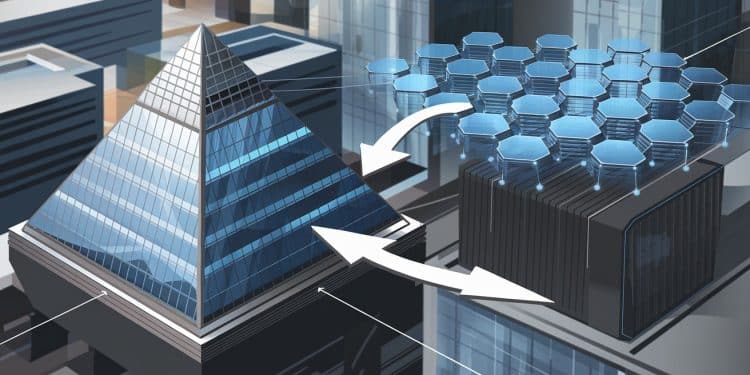

Meta, formerly known as Facebook, employs a dual-class stock structure where Class B shares held by insiders have greater voting power than publicly available Class A shares. This arrangement ensures that founder Mark Zuckerberg retains approximately 58% voting control over the company, making hostile takeovers virtually impossible.

While centralized control may seem antithetical to the decentralized ethos of DAOs, adopting a similar multi-class token structure could provide a balance between decentralization and protection against malicious actors.

Balancing Decentralization and Security

To strike this balance, DAOs could implement a system where certain critical decisions, such as those involving user funds or protocol security, require approval from a class of “super voters” who have demonstrated expertise and alignment with the DAO’s long-term goals. These super voters could be elected by the broader community based on their contributions and track record.

“We need governance systems that reflect the reality of DAOs, systems that balance decentralization with safeguards to ensure long-term viability.”

– Michael Lewellen, OpenZeppelin

Additionally, DAOs should consider implementing Know Your Customer (KYC) initiatives to prevent actors from creating multiple delegate profiles to manipulate governance. Cryptographic techniques like zero-knowledge proofs could help verify identities without compromising anonymity.

Incentivizing Informed Participation

Voter apathy remains a significant challenge in DAO governance, with low participation rates often enabling a small group to wield disproportionate influence. To address this, DAOs must incentivize informed and responsible participation from token holders.

One approach is to reward active engagement, such as participating in discussions, providing feedback, and voting on proposals. By aligning incentives with the DAO’s long-term success, token holders will be more motivated to act as responsible stewards of the protocol.

Preparing for the Worst

Even with a multi-class token structure and incentivized participation, DAOs must remain vigilant against potential attacks. Regular security audits and threat modeling exercises should be standard practice to identify and address vulnerabilities proactively.

DAOs should also develop contingency plans for worst-case scenarios, such as a malicious actor gaining significant voting power. Having clear, pre-established response protocols can help minimize damage and ensure the DAO’s resilience.

The Future of DAO Governance

As the DAO ecosystem matures, it is crucial to learn from the successes and failures of both centralized and decentralized governance models. By adopting a multi-class token structure, encouraging informed participation, and prioritizing security, DAOs can create a more robust and sustainable future for decentralized decision-making.

“Decentralization is an objective good, but it’s not as well-suited for governance as it is for blockchains. We need to find a way to verify that participants are real people without compromising anonymity.”

– Michael Lewellen, OpenZeppelin

The path forward for DAO governance is not without challenges, but by learning from the likes of Meta and adapting their strategies to the decentralized world, DAOs can build more resilient, secure, and effective decision-making structures. The future of decentralized governance is bright, and the lessons learned from centralized giants like Meta will play a crucial role in shaping it.